How to calculate forex position size

Position sizing is one of the most fundamental elements of risk management in forex trading. It determines how much of a currency pair a trader buys or sells in a single trade and directly influences both potential profits and potential losses. Even a strategy with a high probability of success can quickly become unprofitable if the position size is too large for the account. Small trading volumes generate two essential problems for investors because they restrict profit potential and make it challenging to expand capital.

The fundamental principle of position size management involves matching the level of risk to the available amount of account equity. Instead of focusing only on entry signals, traders need to calculate how much of their account they are willing to risk on each trade. This procedure maintains controlled losses at stable levels between different testing environments. The trader's risk exposure to a $10,000 account stands at 1% which means any single trade will have a maximum loss of $100 regardless of the currency pair or stop-loss distance.

Core concepts you must know first

Before calculating position size, it is necessary to understand a few building blocks of forex trading. The first concept is the lot, which represents a standardized contract size. A standard lot equals 100,000 units of the base currency, while a mini lot equals 10,000 units, and a micro lot equals 1,000 units. Some brokers provide nano lots with 100 units which enables traders to select trade sizes that match their available account funds.

The abbreviation “percentage in point” is denoted by the pip symbol. A pip usually refers to the fourth decimal place in most currency pairs, although in pairs that include the Japanese yen, a pip is the second decimal place. The platforms display pipettes as fractional pips which enables traders to achieve higher trading precision.

The connection between these terms requires traders to calculate pip value which represents the monetary worth of one pip movement in their account base currency. The value of Pip depends on the currency pair being traded and the size of the trade and whether the account currency is the same as the quote currency.

The last factor which affects the price of a stock is margin and leverage. A trader can manage bigger positions through leverage but must provide margin as collateral to start and sustain their trades. The three factors of position size determine the maximum amount of account funds that can be risked on a single trade.

The risk framework

The first step in position sizing requires determining the maximum amount of account capital that should go into one trading position. Most traders reserve 1% to 2% of their account equity for risk management to achieve consistent risk levels in all market conditions. A $10,000 account would have a risk limit of $100 because 1% of $10,000 equals $100.

The second step requires traders to determine stop-loss distance which defines the number of pips that will trigger a trade exit. Let’s say the stop is set 50 pips away from entry. The $100 risk limit establishes that each pip has a value of $2. The stop-loss feature stops losses from exceeding the risk limit when it becomes active.

Risk per trade analysis with stop-loss distance enables traders to determine suitable position sizes that match their trading strategy and available capital. This method prevents major losses because one losing trade will not cause excessive damage to capital.

The position size formula

The position size formula needs to be applied after establishing both risk per trade and stop-loss distance. The system performs calculations to verify that all trades meet the selected risk tolerance and stop level requirements.

The process begins with account risk in monetary terms:

The calculation for Account Risk ($) requires multiplying the Account Equity value by the Risk Percentage.

The maximum possible loss would be $100 when starting with $10,000 equity and taking a 1% risk.

Then determine the risk per pip. This is done by dividing the account risk by the stop-loss distance:

Risk per Pip ($) = Account Risk ÷ Stop-Loss (pips).

The stop-loss value of 50 pips results in $2 per pip since $100 divided by 50 equals $2.

The final step requires you to determine your position size in units.

Position Size (units) = Risk per Pip ÷ Pip Value per Unit.

If the pip value is $0.10 per micro lot (1,000 units), then $2 ÷ $0.10 = 20,000 units, or two mini lots.

How to calculate pip value

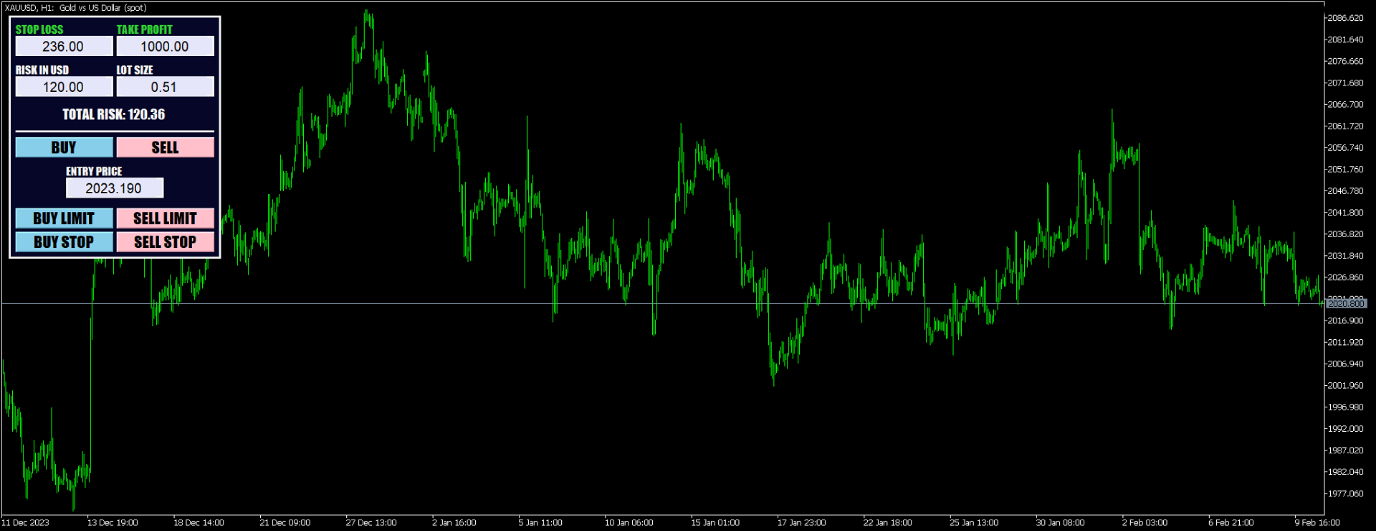

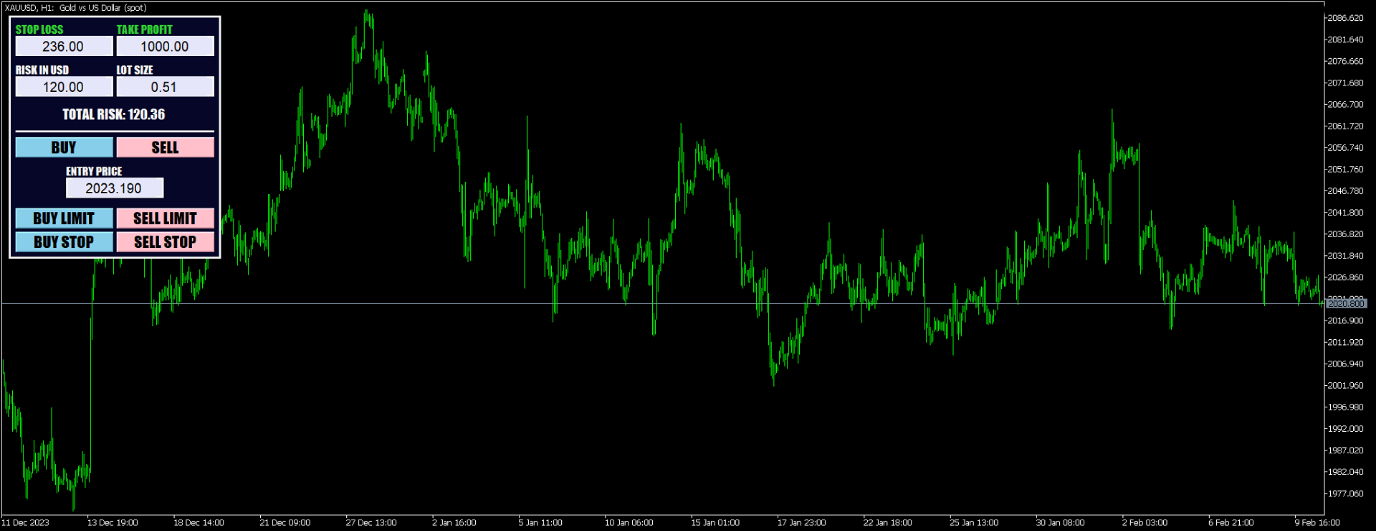

Accurate position sizing depends on knowing the value of a single pip in the account’s base currency. Pip value changes depending on the currency pair, lot size, and whether the account currency matches the pair’s quote currency.

For pairs where the account currency equals the quote currency, the calculation is straightforward. A trader who operates with a USD account would execute trades on the EURUSD pair. A standard lot containing 100,000 units has a value of one pip equal to $10. For a mini lot (10,000 units), one pip is worth $1, and for a micro lot (1,000 units), it is $0.10.

When the account currency is different from the quote currency, an extra conversion step is needed. The calculation of pip value for a USD account trading GBPJPY requires first determining the value in JPY then converting it to USD based on the current USDJPY exchange rate. The stop-loss and take-profit calculation process runs automatically on MetaTrader and users must understand the fundamental concepts.

Certain instruments require extra attention. For JPY pairs, pips are measured at the second decimal place, and for commodities such as gold (XAUUSD), contract specifications differ from standard forex pairs.

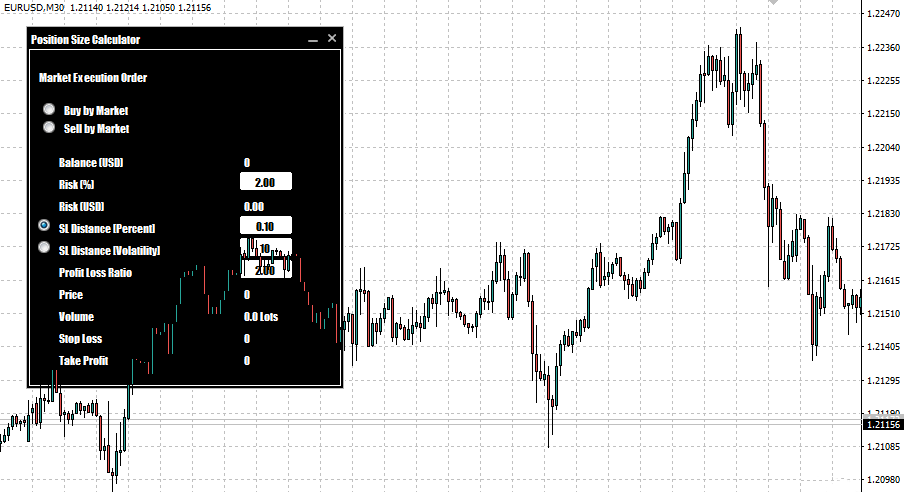

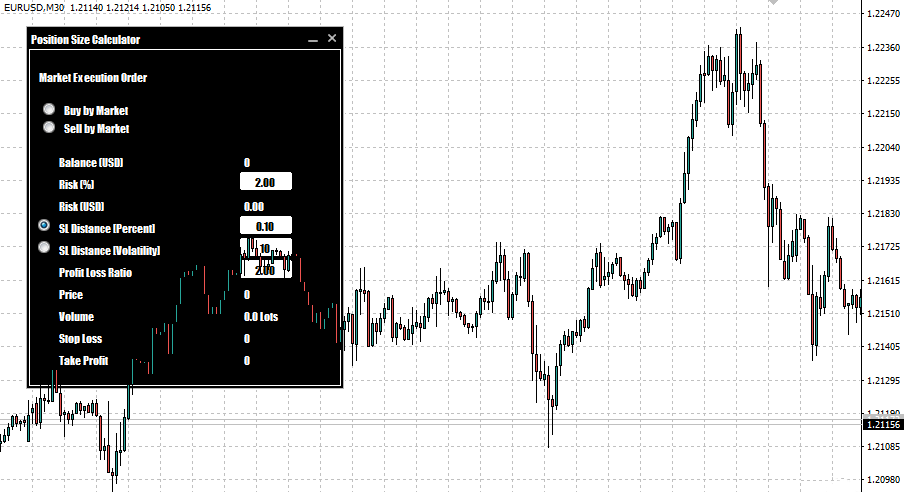

Sizing with volatility-based stops

The traders who want to use volatility for position sizing also set fixed stop-loss levels. Risk management techniques need to adjust their strategies based on the extent of price fluctuations in currency pairs throughout specific time periods to determine volatility. The Average True Range (ATR) indicator serves as the primary indicator for this trading strategy.

For example, if EURUSD has an ATR of 80 pips on the daily chart, setting a stop-loss at 1× ATR means the trade allows for 80 pips of movement. The maximum risk amount of $100 per account limits each pip to a value of $1.25. In this case, the position size would equal one mini lot, or 10,000 units. The system will automatically decrease trading exposure when market volatility increases and the ATR indicator reaches 120 pips because the risk amount stays at $100.

The method stops large trades from happening during market volatility while it prevents small trades from occurring during periods of market calm. Volatility-adjusted stops enable traders to prevent market price fluctuations from triggering stop-outs.

Advanced position sizing methods

Traders implement position sizing methods which extend past fixed-percentage risk rules to achieve maximum trading strategy optimization. The fixed dollar risk method requires traders to assign a specific dollar amount to each trade instead of using equity percentage. A trader would establish a rule to risk exactly $50 on each trade no matter what their account balance shows. The method provides stability but fails to adapt to changes in account size.

The R-multiples method establishes “1R” as the fixed risk amount which traders must allocate to each trading position. A $100 risk level indicates that a $300 profit would be three times greater than the initial risk amount (3R). The framework allows organizations to monitor their strategy performance across time while stopping them from depending only on win rates.

The traders who use scaling methods enter positions at different points and reduce their market exposure when their trades begin to generate profits. The position begins at half size until price confirms direction after which the second half gets added while maintaining risk within predetermined limits.

The Kelly criterion represents a mathematical formula which appears in trading literature for optimizing growth. The system generates aggressive trading sizes that most retail traders cannot use effectively so they need to make conservative adjustments for actual forex market trading.

Leverage, margin, and regulatory constraints

The size of a trade position depends on the leverage amount and the margin requirements. The leverage system enables traders to control trading positions which have higher values than their current account balance. A trader can manage $30,000 in market assets through 1:30 leverage by using only $1,000 of margin. The higher potential for both gains and losses makes traders need to concentrate on proper position sizing.

The amount of collateral needed to start and keep a trade open is known as margin. If a broker requires 3.3% margin for EURUSD, opening a 1 standard lot position ($100,000) would require $3,300 in margin. The system prevents users from trading when their account funds fall below the minimum needed to complete the transaction.

The regulatory framework sets particular leverage limits which differ between various geographic locations. In the United States, retail forex leverage is capped at 1:50 for major pairs, while in Europe under ESMA rules it is restricted to 1:30. The caps for Australia and Japan differ based on instrument and regulatory requirements. These rules exist to defend traders from taking on excessive financial risks.

Conclusion

The process of determining position size represents the core element which enables traders to practice disciplined risk management in forex trading. The process begins with risk percentage determination followed by stop-loss distance measurement which results in position size calculation for systematic capital protection. Risk definition stands as the first step in the fundamental approach which then leads to trade size determination using fixed stops and volatility-based methods.

The correct application of position sizing enables traders to handle market volatility through a systematic approach. The system allows traders to stay in the market until their abilities and trading methods develop into a consistent competitive advantage.