How to choose a forex VPS for trading

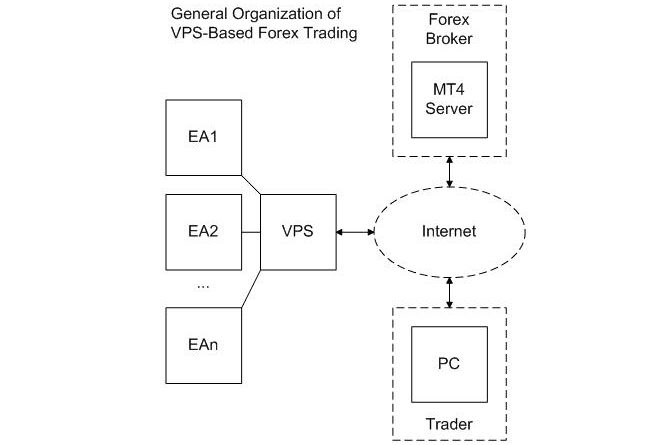

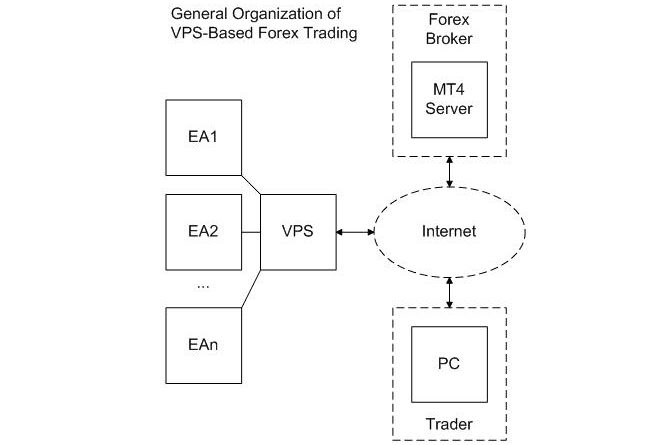

A Virtual Private Server (VPS) operates as a distant computer system which stays active online throughout the entire 24-hour period. Professional data centers enable traders to run MetaTrader 4 and MetaTrader 5 trading platforms through VPS services which eliminate the need for personal laptops and home internet access. The system operates Expert Advisors and automated trading strategies without interruption when the local device loses internet connection or shuts down.

The trader operates an algorithm which executes multiple trading positions throughout each trading day. The algorithm stops working when home internet service fails which results in lost business opportunities. The trading program runs continuously 24/7 on a VPS system which operates independently from local environmental factors. Users can access their trading account through the system from any internet-enabled location while experiencing consistent system performance.

The case for hosting near your broker

Latency in forex trading refers to the time it takes for an order to travel from the trading platform to the broker’s server. A trade will either occur at its expected price or not based on a single fraction of a second. Scalping and high-frequency trading need latency reduction because their profits come from minimal market price movements.

The order originates from a VPS server in London before it reaches the broker's server which operates within the same city. The round-trip time might be just 1–2 milliseconds. The same order would experience latency that exceeds 100 milliseconds when sent through a home connection in a different region. The brief time difference between market entry and exit points becomes vital in fast markets because it decides between successful market entry and unexpected price movements.

Location strategy

The first step to choose a VPS location involves identifying the server locations operated by the broker. Many brokers publish this information or provide it upon request. Servers are typically located in major financial data centers such as London LD4, New York NY4, Tokyo TY3, or Singapore. The VPS server located in the same region as the trading platform provides fast order processing and low latency because it reduces physical distance to broker servers.

A VPS located in the same city as the broker's New York servers will deliver latency that amounts to only a few milliseconds. The order transmission time will become substantially longer when you use a European VPS to connect to a New York server. The time difference between market orders and limit orders matters most to day traders and scalpers who require immediate execution but it has limited impact on traders who hold positions for weeks.

Before buying a service you should perform latency tests or ping checks from possible VPS locations to the broker servers as a useful method for service selection. The system lets traders pick VPS locations according to their trading methods which results in faster execution times and better cost-effectiveness and accessibility.

Core specs that matter

Technical specification evaluation of VPS options helps traders avoid spending extra resources that do not boost their trading results. The evaluation process needs to examine CPU performance as well as RAM capacity and storage capabilities and bandwidth speed.

The trading platforms MetaTrader 4 and 5 need average CPU power but they need it to run smoothly. A terminal with several Expert Advisors can function with only one virtual CPU. The system will run more smoothly with two or more dedicated cores when using multiple terminals or resource-intensive strategies.

RAM functions as an essential part of the system structure. The operation of one MetaTrader instance requires 1 GB of memory but running multiple platforms or advanced indicators needs 2–4 GB to achieve smooth performance. The storage system needs SSD or NVMe technology because it provides fast read/write operations which minimizes delays when accessing charts logs and historical data.

Reliability & uptime

Reliability stands as the primary factor which determines the selection of a Forex VPS. The trading platform needs continuous operation because automated trading systems execute trades throughout all hours of the day. Most VPS providers provide uptime guarantees which they express as a percentage value. The uptime guarantee of 99.9% means the system will be unavailable for less than nine hours throughout a complete year but 99.99% uptime reduces this time to under one hour. The execution guarantees between trading platforms create significant differences that affect trading strategies which need continuous execution.

The reliability of a product depends on its customer support system as a crucial factor. A technical team that responds quickly to server problems and security updates and unexpected outages minimizes risks while ensuring trading operations maintain uninterrupted operation.

Security must-haves

A Forex VPS requires both high performance and reliability and security because it holds account information and performs automated trading operations. The foundation of security exists within the initial connection process. Remote Desktop Protocol (RDP) sessions need to implement strong encryption through TLS to stop unauthorized data interception. The providers use two-factor authentication which demands users to perform an additional verification process after password entry to stop unauthorized system access.

A trader who establishes a VPS account with basic username and password authentication. The system faces a risk of brute-force attacks because automated systems can attempt to guess user login credentials. The system protects against compromise by using account lockout features and firewall security and password complexity rules.

The system needs regular updates as its core operational necessity. Attackers exploit security weaknesses by using outdated operating systems and trading platforms. A good provider offers automatic update management or simple tools which enable users to update their software quickly. The platforms use DDoS protection systems to prevent service disruptions that could occur during times of peak trading activity.

Managed vs unmanaged VPS

When choosing a Forex VPS, one of the key decisions is whether to use a managed or unmanaged service. The main distinction exists in terms of server maintenance duties between the two options. The provider manages technical support and system updates and monitoring and backup services for a managed VPS. The server management option provides traders with the ability to focus on their trading strategies while the server operations are handled by someone else.

A trader who operates multiple Expert Advisors needs to prevent system errors because they cannot afford any downtime. The provider handles updates to the operating system and security patches and performance issues on a managed VPS. The system functions with lower failure risks when markets stay open for trading activities.

On the other hand, an unmanaged VPS is essentially self-service. The provider gives access to the server environment but users must handle all tasks including update applications and security configurations and system troubleshooting. The option is best for technically skilled traders who want to customize their server completely while saving money on monthly costs.

Broker-sponsored (Free) VPS: Pros, cons, and fine print

Free VPS services are available from specific brokers who provide them to their clients under specific account requirements. The system offers cost advantages to traders but they need to understand all the conditions. The VPS service becomes available to clients who either fund their account to a minimum level or reach particular monthly trading volume thresholds.

The broker offers free VPS hosting to clients who keep their equity balance at $5,000 or more and complete more than 10 lots per month. The arrangement removes the need for a separate VPS fee but it might lead to trading volumes exceeding the necessary levels. The requirements for traders with low trading volume become difficult to fulfill.

Another consideration is control. The VPS solutions provided by brokers usually support only specific platforms including MetaTrader and they provide less flexibility in terms of customization than independent VPS providers. The system encounters operational difficulties because it lacks the capability to run operations between different platforms and specialized monitoring tools at the same time which creates problems for traders who operate multiple systems.

Setup & hardening checklist

The selection of a VPS requires proper setup for both operational efficiency and security purposes. The initial requirement involves creating dependable access systems. Organizations need to protect Remote Desktop Protocol through robust password security and they should activate multi-factor authentication whenever possible. The provider allows users to activate login alerts which function as an extra security system to identify unauthorized access attempts.

The following section deals with firewall configuration. The practice of blocking unused ports together with the authorization of necessary connections for MetaTrader or cTrader operations minimizes system exposure. The default rules which providers offer need adjustment to specific trading requirements for enhanced security.

Installing the trading platform comes next. Users should download MetaTrader 4 or 5 from the official websites of their brokers or developers to prevent downloading infected files. The platform will continue running Expert Advisors or scripts after a server reboot when it is set to launch at startup.

Users must save their configuration files through the process for backup purposes. The system requires users to save their profiles and templates and log data at predetermined intervals for backup purposes which can be stored either through the VPS provider’s snapshot system or an external cloud storage solution. The system needs a test run to complete its operation. The VPS system operates around the clock 24/7 to track performance which allows it to identify connectivity and execution problems before starting live trading.

Testing your VPS before going live

Testing must be performed before using a VPS for live trading to verify that the setup functions correctly. A simple way to begin is by checking latency. This can be done with a ping or traceroute command directed at the broker’s trading server. The test results show an optimized connection because the response time has reached 2 milliseconds. A VPS system will not function for high-frequency trading operations when its latency reaches above 100 milliseconds.

The trading platform needs to operate for at least 24 hours straight to detect any stability problems. The system needs to verify order execution logs for any possible delays or disconnections that occurred during this period. The system requires multiple reconnections during a short time span because this recurring pattern indicates network instability that must be fixed before beginning live trading operations.

Simulated trades or micro-lot orders can also be placed to measure how long it takes for orders to appear in the trade history compared with the execution time shown in the logs. The evaluation of resource usage through CPU and RAM monitoring helps us determine if the VPS has sufficient resources to perform the intended trading operations.