How to transition from demo to live forex trading

The step from demo trading to live forex trading is where practice meets reality. The demo account provides users with a protected space to discover platform functionality and execute order types while learning about fundamental concepts including lots and pip values and margin and leverage. The standard lot in forex trading represents 100,000 base currency units while major pairs experience price movements of about USD 10 per pip. The numbers on a demo account exist as theoretical values but they translate into actual financial dangers when trading with real money on a live account.

While the mechanics remain the same, conditions change once real money is on the line. Market conditions determine execution speed because market volatility leads to wider spreads which produce slippage that affects the final fill price. The elements that affect profit and loss results in actual trading operations become visible during live market conditions but remain hidden in demo trading environments.

Demo vs. live

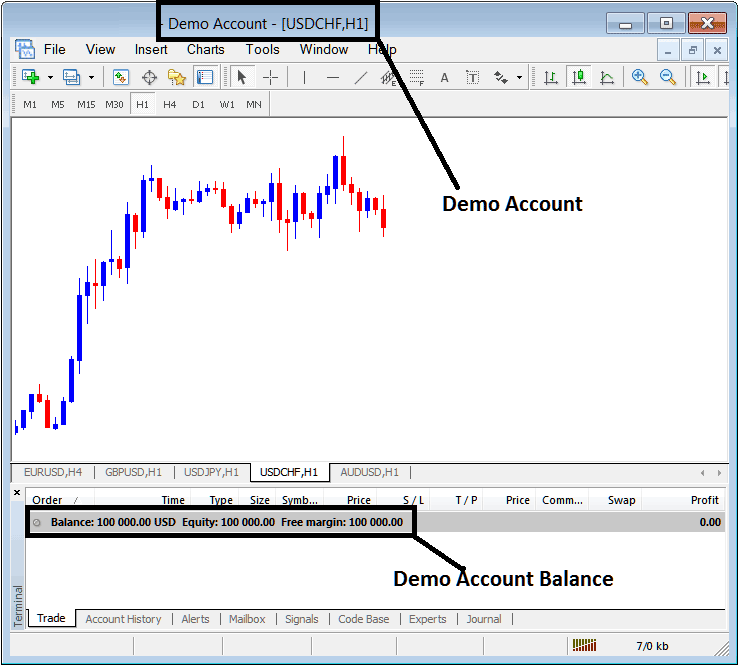

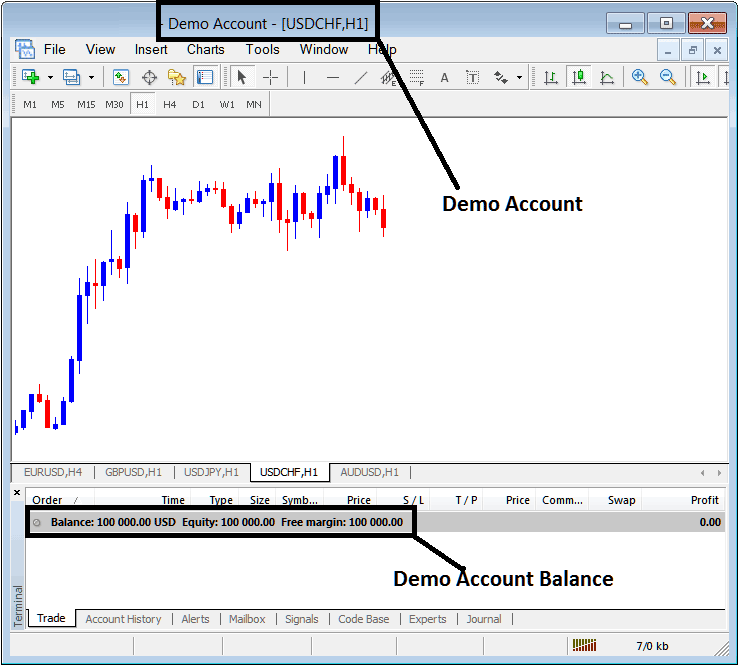

A demo account operates as a trading simulation because it uses real market prices to enable traders to place orders and determine pip values and master leverage management. For example, on both demo and live accounts, opening a 0.10 lot position on EUR/USD still represents 10,000 units of the base currency, and each pip movement is worth about USD 1. The regular practice allows traders to build their technical skills before they start trading with real money.

The execution methods together with psychological approaches represent the primary distinction between these two methods. The prices in live markets tend to spread out during news release volatility and slippage happens when prices shift before orders complete execution. The elements create direct effects on profit and loss but they stay hidden in demo environments. The way margin requirements are put into practice leads to separate outcomes. The margin requirement for a 0.10 lot trade with 30:1 leverage amounts to USD 333. The demo version appears feasible but users should exercise caution when making a financial investment.

Regulatory & broker foundations

The process of choosing a broker and obtaining regulatory protection represents the critical first step which allows traders to move from demo to live trading. A regulated broker operates under financial authorities which enforce rules about transparency and client fund protection and fair dealing. Major jurisdictions enforce regulations that force brokers to store client funds in separate accounts which protect trading capital from being used for operational costs.

The broker provides detailed information about margin and leverage and costs through their product disclosure statement and key information document. A broker provides major currency pair trading with leverage at 30:1. This means that opening a position worth USD 30,000 requires only USD 1,000 in margin. The funding requirements and overnight financing costs and commission structures between brokers show major differences. The information allows traders to determine their complete trading expenses with absolute precision.

It is also advisable to check order execution policies. The selection between straight-through processing and dealing desk models operated by brokers determines the behavior of spreads and slippage when markets experience fast price changes. The official registers of authorities like CFTC in the United States and FCA in the United Kingdom and ASIC in Australia contain information to verify regulatory status of traders.

Checklist before you go live

The structured readiness checklist enables traders to validate their ability to use demo environment skills during actual market trading. The first requirement is to validate the strategy. A trading plan needs to prove its effectiveness by undergoing tests across various market conditions which include trending and range-bound periods to validate entry rules and exit strategies and risk management protocols. A forward test requires at least 100 trades on a demo account to verify that the strategy produces positive expectancy after transaction fees.

Operational readiness is equally important. Traders should be fully confident in using order types such as market, limit, and stop orders, as well as setting protective stops and take-profit levels. Let’s say a trader wants to risk 1% of a USD 5,000 account per trade. With a stop-loss of 50 pips on EUR/USD, and each pip worth USD 1 at a 0.10 lot size, the position should be adjusted to match the risk amount of USD 50. The practice of these calculations in advance helps traders prevent costly errors that occur during actual market trading.

Capital & risk planning

A capital plan with proper structure serves as a fundamental necessity to move from demo to live trading operations. The first principle requires you to fund your account with risk capital which represents money that will not impact your basic living costs. Your initial investment should be minimal because it will help you manage your finances better while allowing your business to grow according to your skill development pace.

Risk management exists as a system which relies on position sizing as its core operational principle. A trader who holds USD 5,000 in their live account sets their trading risk at USD 50 per trade which amounts to 1% of their total account funds. If a setup requires a 25-pip stop-loss on EUR/USD and the pip value is USD 1 per 0.10 lot, the correct trade size would be 0.20 lots, since 25 pips × USD 2 = USD 50. The framework preserves established loss levels during periods of market volatility.

The process of boundary creation requires equal attention to defining total boundaries. The trading system features 2% daily loss restrictions and 5% weekly limits to protect against major drawdowns.

A staged transition plan

A person needs to follow a structured approach to achieve a successful transition from demo trading to live trading. The initial trading phase requires investors to start with the smallest possible position size which typically consists of micro lots (0.01). A trading account starts with USD 2,000 and each trading position requires a risk of USD 5. The live trading environment presents actual slippage and spread variations and emotional stress which were less significant during demo trading although the financial risk remains minimal. The last phase assesses whether the trading plan continues to work when using real trading capital.

The second phase of trading begins after establishing consistency through the use of 0.10 lots as the baseline trade size while maintaining 1% risk per trade. A trader needs to evaluate between 50 to 100 trades before they can maintain their discipline when they decide to increase their trading volume.

The third development stage needs to expand in a controlled manner. The position sizes need to be adjusted step by step based on account equity while keeping the risk parameters unchanged.

Execution quality & tech setup

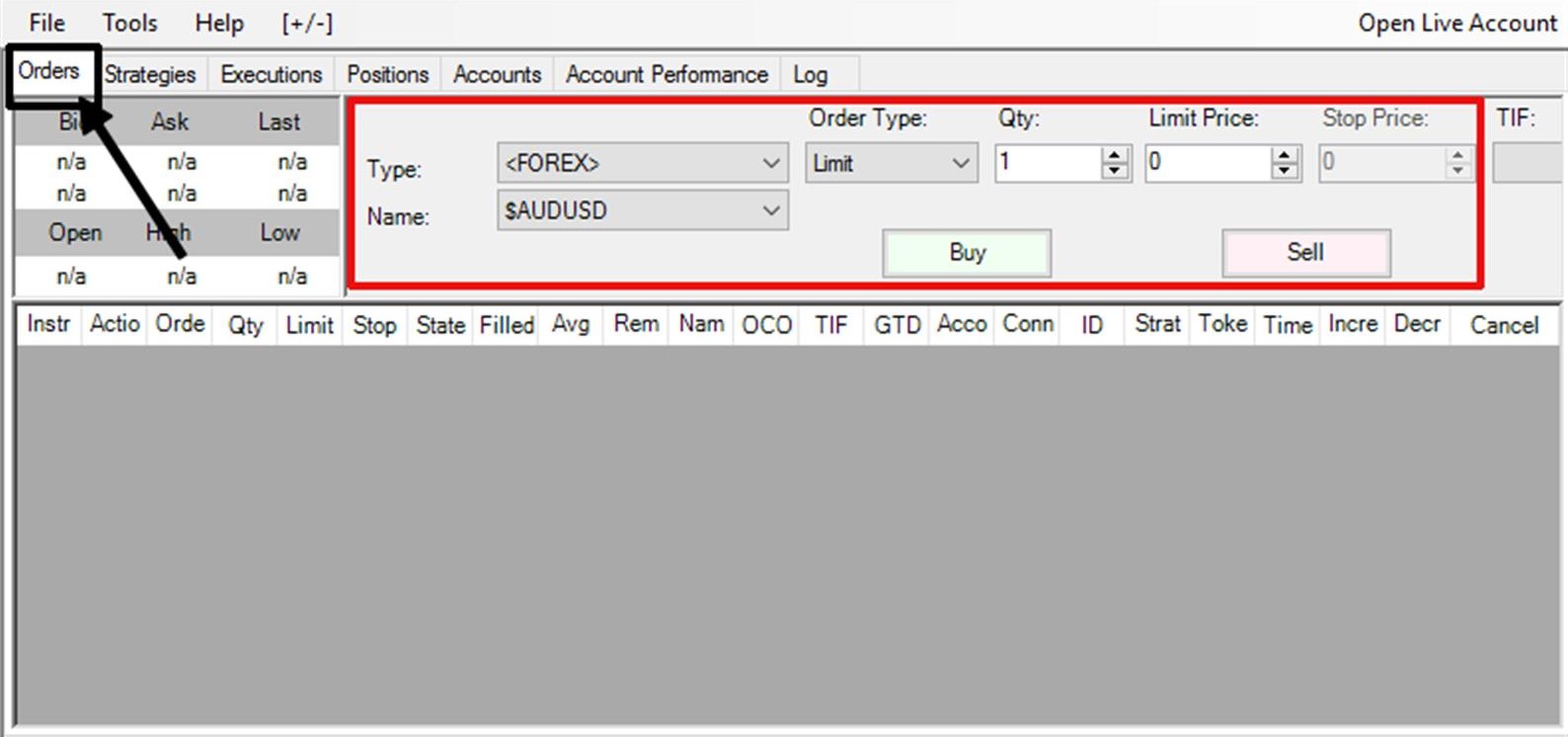

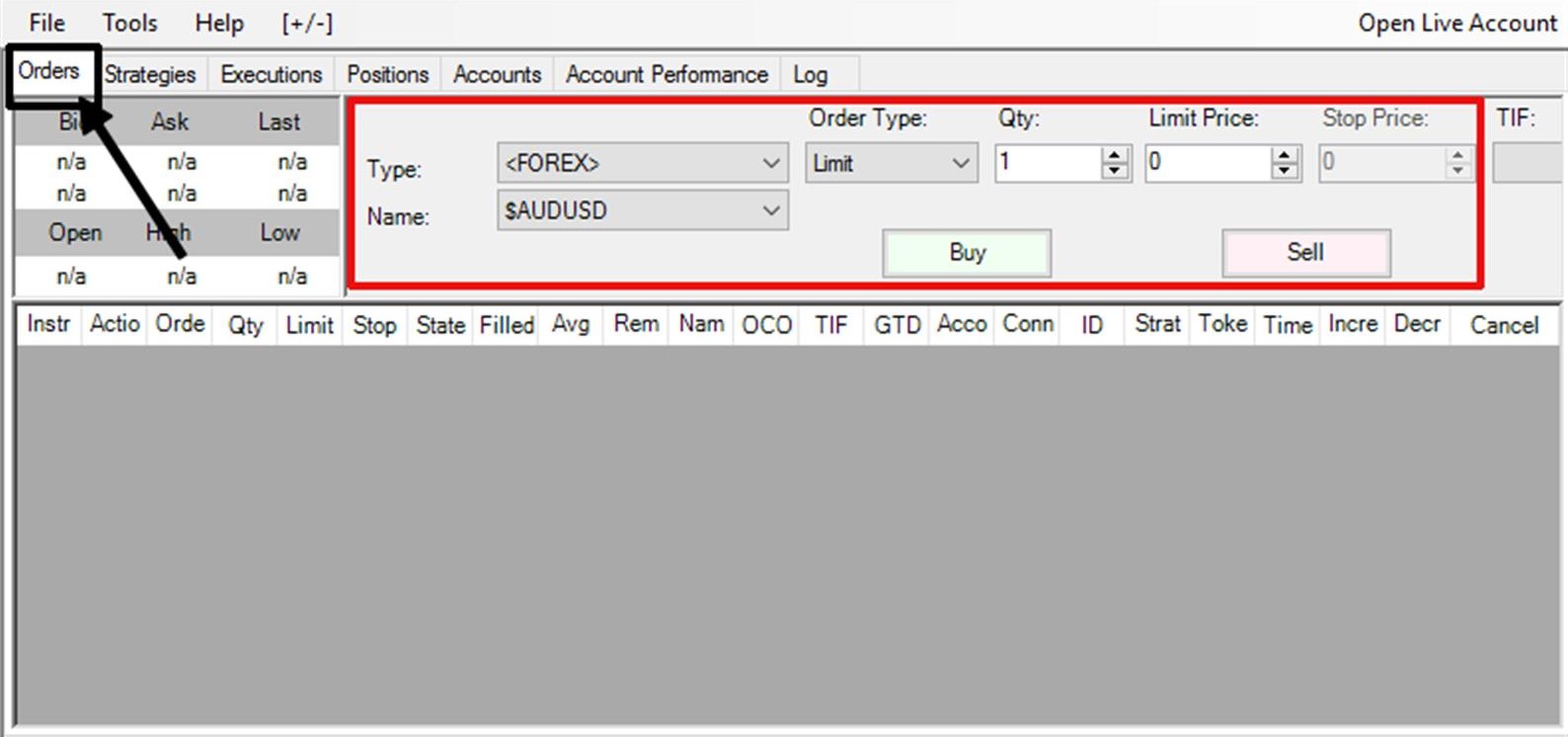

The quality of execution becomes the primary factor that determines trading success after traders move from demo to live market conditions. A strategy that has proven successful will fail if order execution becomes slow. Short-term trading methods including scalping become less profitable when slippage occurs or spreads widen or orders take longer to execute. The process of monitoring trade confirmations with actual fill price comparison enables the detection of execution consistency.

The technology setup process functions as a fundamental requirement. Traders can perform different order types and monitor their margin usage through platforms such as MetaTrader 4 or 5 while using the platform to automate particular tasks. A trader initiates a purchase transaction at 1.0850 while setting his stop-loss at 20 pips and take-profit at 40 pips. The trade execution system operates through pre-defined levels which execute orders automatically based on set criteria that prevent human intervention during market volatility.

Journaling, data, and review

A trading journal serves as an essential instrument for traders to assess their performance after they start trading in real market conditions. The recording of each trade with entry price and stop-loss and take-profit and lot size and rationale provides a complete view of decision-making. The EUR/USD trade needs to be recorded with its expected risk of USD 30 and reward of USD 60 when using a 30-pip stop and 60-pip target at 0.10 lots. The documentation process enables us to determine the difference between our initial targets and the final results we achieved.

The use of performance tracking metrics creates an environment which requires people to accept responsibility for their work activities. The key performance indicators for trading success consist of win rate and average risk-to-reward ratio and maximum drawdown and expectancy per trade. Let’s say a trader has a 45% win rate but an average risk-to-reward of 1:2. The system will produce positive returns in the long run as long as the rules are applied without deviation. Systematic record-keeping methods should be used for pattern detection instead of depending on human memory.

The journal operates as a feedback system through its scheduled review process which prevents it from becoming a basic data storage system. The short-term execution problems become apparent during weekly reviews but the monthly reviews show how risk management consistency and psychological triggers change over time.

Common transition mistakes

Many traders face difficulties when moving from demo trading to live trading because they make avoidable errors. Let’s say an account of USD 3,000 is opened and the trader risks USD 300 on a single position. Your capital will decrease by 10% when you experience a trade loss which will also create mental distress that may result in further trading errors. The protection of capital becomes possible through maintaining a risk level of 1% per trade.

Traders who experience several losing trades tend to give up on their proven strategies in order to find fast solutions. The lack of particular guidelines leads to inconsistent work results while creating difficulties for tracking performance indicators. A defined strategy needs to be followed for at least 50–100 trades to perform effective analysis.

The practice of overtrading results in negative effects on business performance. The execution of two trades as planned becomes impossible when six trades are executed because it leads to higher transaction costs and weaker market discipline. Creating rules such as a daily trade limit prevents this behavior.